09 Aug Co-Working Spaces at the Forefront of India’s Office Workspace Market

The commercial office space in India saw recovery in occupancy rates and leasing after a two-year pandemic-induced turmoil. A JLL report titled ‘Q4 2022 Office Market Update for India’ reveals that net absorption across seven major cities (Delhi NCR, Mumbai, Bengaluru, Chennai, Hyderabad, Pune, and Kolkata) for 2022 crossed the five-year pre-pandemic average (2015-2019) by 3.1%. Significant project completions coupled with a push towards ‘return to work’ contributed to this growth. And the rising demand for flexible and hybrid workspaces, created a strong impetus for co-working and managed office spaces as well – given that their lure lies in their varied locations, including residential areas, malls, and even hotels.

The co-working model, which emerged as a fusion of business centres, offices, and cafes has been around since 2005, but gained prominence post-pandemic to establish its unique identity. Occupancy rates of co-working spaces in India jumped from 45-60% in Jan 2022 to 90-100% in Jan 2023. Moreover, with a booming Indian start-up ecosystem, coupled with the country’s plans of positioning itself as the future global start-up hub (like Ubud, Indonesia), the numbers appear to support this growth. The total number of startups in India grew from nearly 350 in 2014 to 90K+ (including 100+ unicorns) by Apr 2023.

Companies have started recognizing that flexible working spaces foster innovative work approach, may enhance productivity, and that the asset light business model is well suited to the agile business needs of freelancers, start-ups, SMEs and in many instances large enterprises. Individuals and SMEs do not have to commit to long-term leases, and companies can rent workstations for their short-term projects, which proves to be cost-effective.

Going by a report from Anarock Property Consultants, in Q1 2023, out of the total lease volume of ~8.2 million sq. ft., co-working spaces held 27% (~2.1mn sq. ft), with Delhi NCR and Bengaluru collectively accounting for almost 66% (~1.4mn sq. ft.) of the total co-working spaces. Not only metropolitan cities, the demand for flexi-space operators is gaining traction in Tier 2 & Tier 3 cities such as Ahmedabad, Coimbatore, Indore, Jaipur, and Lucknow as well.

Companies (typically larger enterprises) are also increasingly opting to move some operations to smaller cities to reduce real estate costs and attrition, while further enhancing work-life balance for their workforce, who would have otherwise had to relocate to larger cities from their towns of residence.

The global co-working market was worth $7.9b in 2022 and is projected to reach $24b by 2030, registering a CAGR of almost 15% in this eight-year period. India is also expected to mirror this global growth with the total number of seats in the co-working segment expected to cross the one million-mark by 2025.

There are over 2K coworking spaces in India. Prominent players in the market are WeWork (2010, US) with 40+ locations in India and 800+ globally; CoWrks (2016, Bengaluru), managed and operated by Brookfield Properties, with 22 locations across six regions in India; New Delhi-based Innov8 (2015) with 35 centres across 10 major cities, 91Springboard (2012, Delhi) with over 30 locations across India, Awfis (2015, Delhi) with operations in 17 cities with 150 centres and 88K seats across India. Other dominant companies are The Address, BHIVE Workspace, and Smartworks.

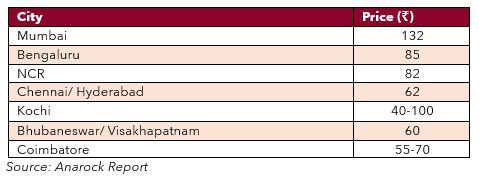

A comparative assessment of the pricing structures reveals the edge that co-working spaces have over traditional office spaces. The average price of renting a traditional office space in India by region (per sq. ft. per month) is as below:

In metros, the average cost of renting a traditional office is ₹80 – 250 per sq. ft, and including ₹60 for facility management (electricity, maintenance, security, HVAC, etc.) the total cost increases to ₹140 – 310 per sq. ft. Assuming an average space requirement of 70 sq. ft. per person, the total cost varies between ₹10K to ₹22K PPPM (per person per month). Whereas, in co-working the average costs are ₹8K – ₹14K PPPM, resulting in 20-30% cost savings.

However, shared workspaces come with their share of problem areas as well, which organizations must be cognizant of to take better decisions about their workspaces:

- Constant distractions – as co-working spaces tend to cater to a multitude of companies; some of the places might be noisy making it a challenge to focus on creative tasks

- Privacy concerns – co-workers may disregard comfort and privacy of others leading to less-than-ideal workspaces

- Limited resources – accommodating the needs of all occupants may be challenging for some of the smaller operators with limited resources, resulting in failure of business

- Schedules – some co-working spaces provide 24/7 access while some do not; this might not be suitable for a company which caters to clients globally and works round the clock

There are also some related business challenges, such as:

- Security – as customers, these companies do not have control on who comes in and who goes out of shared spaces. Also, for some companies (finance or law), cybersecurity may also be a challenge due to shared networks.

- Leases – co-working operators work on subletting; they have cheaper long-term leases which they sub lease for short-term. If the tenure or occupancy is less, companies may have to shift with them.

The pandemic has drastically shifted the perception of traditional workplaces, highlighting the importance of flexibility. Coworking spaces are adapting to this demand, offering upgraded and innovative environments that appeal to the millennial workforce. However, some organizations might see a challenge there, especially in cases where they have very specific requirements for their workspaces – extreme customization is not the greatest selling point for shared workspaces anyway. If the rise in demand is any indication, the prevalence of co-working spaces is only going to get more intense, not just in Tier 1 cities but in smaller towns too.

Authors: Shivam Agarwal, Assistant Consultant (Strategy Consulting)

Deepanshu Arora, Assistant Consultant (Strategy Consulting)

Image courtesy: Austin Distel on Unsplash

No Comments