25 Oct Getting Green Cess to Help Arrest Climatic Degradation

Green taxes, also known as green cess, are fiscal instruments imposed by governments to address activities or products that have a negative impact on the environment. Their purpose is to internalise the environmental costs associated with these activities and encourage the adoption of sustainable practices. While the concept of green taxes originated from “Polluter Pays Principle” in the 1970s, it has gained global prominence in recent years, on the back of Environmental, Social and Governance (ESG) Practices.

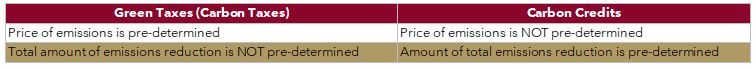

Green taxes serve as market-based incentives, making environmentally harmful activities more expensive and encouraging individuals and businesses to opt for sustainable alternatives. The tax collected acts as a funding source for environmental initiatives, such as renewable energy projects, conservation efforts, sustainable infrastructure development and waste management. Though historically, carbon trading – in the form of carbon credits and carbon offsets – have been used by companies and countries to square off the net carbon emissions, large-scale implementation of green taxes globally is set to drive decarbonisation efforts. A quick comparison shows that with green taxes, companies will have to become more responsible towards their net carbon emissions.

With increasing focus on decarbonisation, the EU has become a frontrunner in implementing policies and laws towards Green Cess. The EU’s Carbon Border Adjustment Mechanism (CBAM), due to enter the transition phase in Oct 2023, and become effective in 2026, plans to put a fair price on the carbon emitted during the production process of the goods entering the EU. CBAM will cover six sectors including aluminium, cement, electricity, fertilizers, iron & steel, and hydrogen.

France, Sweden, and Denmark are notable examples of countries that consistently prioritise environmental sustainability and allocate significant resources to such initiatives. France and Sweden have highest green tax rates in the world at ~$133 and $124 per metric ton of CO2 emissions respectively, making them the highest carbon taxes countries globally (India has amongst the lowest in the world, at just $1.6 per ton of CO2 emissions).

Green taxes have demonstrated their effectiveness in reducing environmental harm and promoting sustainable practices. Sweden’s carbon tax, for instance, resulted in a 25% reduction in emissions from taxed sectors by 2018. Ireland’s plastic bag tax led to a remarkable 90% reduction in plastic bag usage since its introduction in 2002. High fuel taxes in countries like Norway, the Netherlands, and Denmark have stimulated the adoption of electric vehicles and use of cycles/ e-cycles, leading to reduced carbon emissions from transportation. A research paper published on MDPI (Jun 2023, data from 1995 to 2019) has empirically proven that for OECD countries a 1% rise in total revenue from environmental taxes correlates with a 0.024% to 0.031% decrease in CO2 emissions.

In India, the Clean Environment Cess (CEC) was introduced in 2010 as a fiscal tool to reduce the use of coal and associated carbon emissions. Further, green tax is also levied on commercial vehicles entering certain cities to combat air pollution and congestion. Multiple state governments are progressive with Delhi, Maharashtra (Mumbai), and Karnataka (Bengaluru) being the top three states collecting maximum green taxes. Goa recently tabled a green cess law (on products and substances causing pollution) that was upheld by the Bombay High Court, dismissing pleas of companies handling coal and hazardous chemicals and petroleum products against the law.

However, implementing carbon taxes in countries like India and China (per global standards) can impact economic growth negatively, and hence, any decision should be considered thoroughly. Carbon taxes will increase cost of production for commodities, utilities and may impact revenue distribution as well. Further, EU’s CBAM will increase reporting requirements for the exporters in other countries, especially in India and China (impacted the most due to loss of price competitiveness). As per research paper published in PubMed Central (PMCID: PMC9914963), at a carbon tax rate of $27/ton in China, GDP will decrease by an average of 2.57%. Also, the top three sectors that will be most affected by this tax would be electricity generation and distribution, (14.8% reduction), construction (5.8% reduction) and nonmetal mineral products (5.2%). Therefore, it is imperative for India and China to work towards decarbonisation and develop carefully crafted policy packages to provide broader and stronger mitigation incentives.

Green taxes play a vital role in internalizing environmental costs, incentivizing sustainable practices, and funding environmental initiatives. Countries worldwide have implemented various forms of green taxation, with revenue allocated to sectors for long-term sustenance. However, addressing challenges related to fairness, enforcement, and potential resistance is essential for the successful implementation of green taxes. By overcoming these hurdles, governments can harness the power of green taxes to drive environmental sustainability and create a greener future. Also, manufacturing hubs, such as India and China should chalk out a well-rounded strategy and taxation structure that promotes the domestic industries in becoming environmentally sustainable. Both private entities and governments hold pivotal responsibilities while balancing economic growth.

Author: Manish Mishra,

Head, Strategy Consulting

No Comments