14 Jun Turmoil in the 2-Wheeler EV Ecosystem

Effective June 1st, the Government of India has decided to significantly reduce the subsidies on electric two-wheeler (EV 2W) under the FAME II Scheme (Faster Adoption and Manufacturing of Electric Vehicles).

The FAME scheme was a part of the National Electric Mobility Mission Plan, and was first introduced in 2015, by the Ministry of Heavy Industries and Public Enterprises to incentivize and promote the production and sale of eco-friendly vehicles. The first phase of the scheme was for a period of four years that completed in March-2019. In phase 1 (FY16-19) the government aimed to invest up to Rs 14,000 crore, but only ~INR529Cr were spent in the four years.

The second phase or FAME II scheme, launched in April-2019, would have been completed by March 2022, however, has now been extended till March 2024. The government has planned to spend Rs 10,000 crore in the form of subsidies during this period.

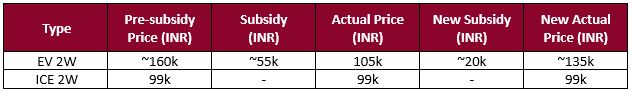

As the target funding under FAME II is close to exhaustion, with no additional allocation of funds, the government’s objective is to manage the show for the rest of the year with the same funding. Therefore, to ensure the longevity of the scheme till Mar-2024, the decision to reduce the subsidy was taken. Anyways, with the current disbursal rate, the subsidies would have lasted for just two months. Going forward, the demand incentive per kilowatt hour (KWH) will be reduced to Rs 10,000 from Rs 15,000 with a maximum cap of 15% of the vehicle’s ex-factory price, which was 40% previously.

Following these changes, the electric two-wheelers are bound to get expensive. Further, if the OEMs think of completely passing on the reduced subsidy to the customers, it will certainly impact the customers buying behaviour, bringing down overall EV 2W sales. Various EV companies are currently evaluating price increases, ranging between Rs 11,000 to Rs 30,000. As per the current FAME-II subsidy mechanism, the payback period on the total cost of ownership is close to about three years, however, with the new regulations, it is speculated to increase to five years. Also, with initial cost of going up, the uptake could be low, leading to slowdown in EV penetration.

It seems, in future, it will be challenging for the EV two-wheeler industry, especially small players, to survive with decline in subsidies and demand. These players may find it hard to sustain operations, as new rounds of fundraising may also be at risk. It will be a setback for bigger players as well, as they are yet to localize their entire supply chain. Also, with expected price rise, customers will increasingly look for the trusted and proven brands to justify their higher upfront cost. This will further lead to market consolidation and create a congenial environment for established players for growth, compared to smaller players.

The biggest impediment for the EV 2W market growth would be the higher upfront prices, as most of the potential customers are yet to be convinced of the savings through the lower running costs of EVs compared with a conventional two-wheeler. This means the target to achieve lower emissions through higher penetration of EVs may hit a serious roadblock. ICRA cut its estimate of EV 2W penetration by FY25 to 10-12% from 13–15%. Electric vehicles currently constitute ~5% of overall 2W sales.

Moreover, the government has no plan to extend the FAME II scheme beyond Mar-2024 or introduce any FAME III scheme. Subsidized prices cannot revolutionize the industry or drive the growth, and hence, these eventually need to become self-sustainable. It looks like EV 2W sales that recorded phenomenal growth in 2022 (305% YoY) may be dented in near future, forcing companies to introduce new EV technologies at reasonable prices in quick time.

Typically, the Indian market is very price sensitive and consumers would expectedly gravitate towards cheaper options instead of the more expensive EVs. The government will have to come up with other ingenious strategies to conserve the momentum of this shift towards EVs. Nurturing an ecosystem which helps reduce input costs, offering tax benefits in some form, introducing a sort of production linked incentives (PLI) can be some of the options that the government might consider. Bringing the subsidy scheme to a complete halt and not extending any other form of benefit might end up deterring customers from making the shift towards EV 2Ws, a situation that might not be desirable for the government.

Author: Sanprati Sharma,

Assistant Consultant, Strategy Consulting

Image courtesy: Hero Electric

No Comments